Money management is never an easy thing to learn, and it’s not necessarily something that school teaches you. Financial literacy and money management skills are some of the most crucial things to learn before becoming independent and heading out into the world. Robert Kiyosaki, author of Rich Dad Poor Dad (the #1 personal finance book of all time) says:

If you don’t know how to care about money, money will stay away from you

And no one wants the money to stay away from them. So, to make it easy for you to keep your money, here are my top 5 money management tips for teens.

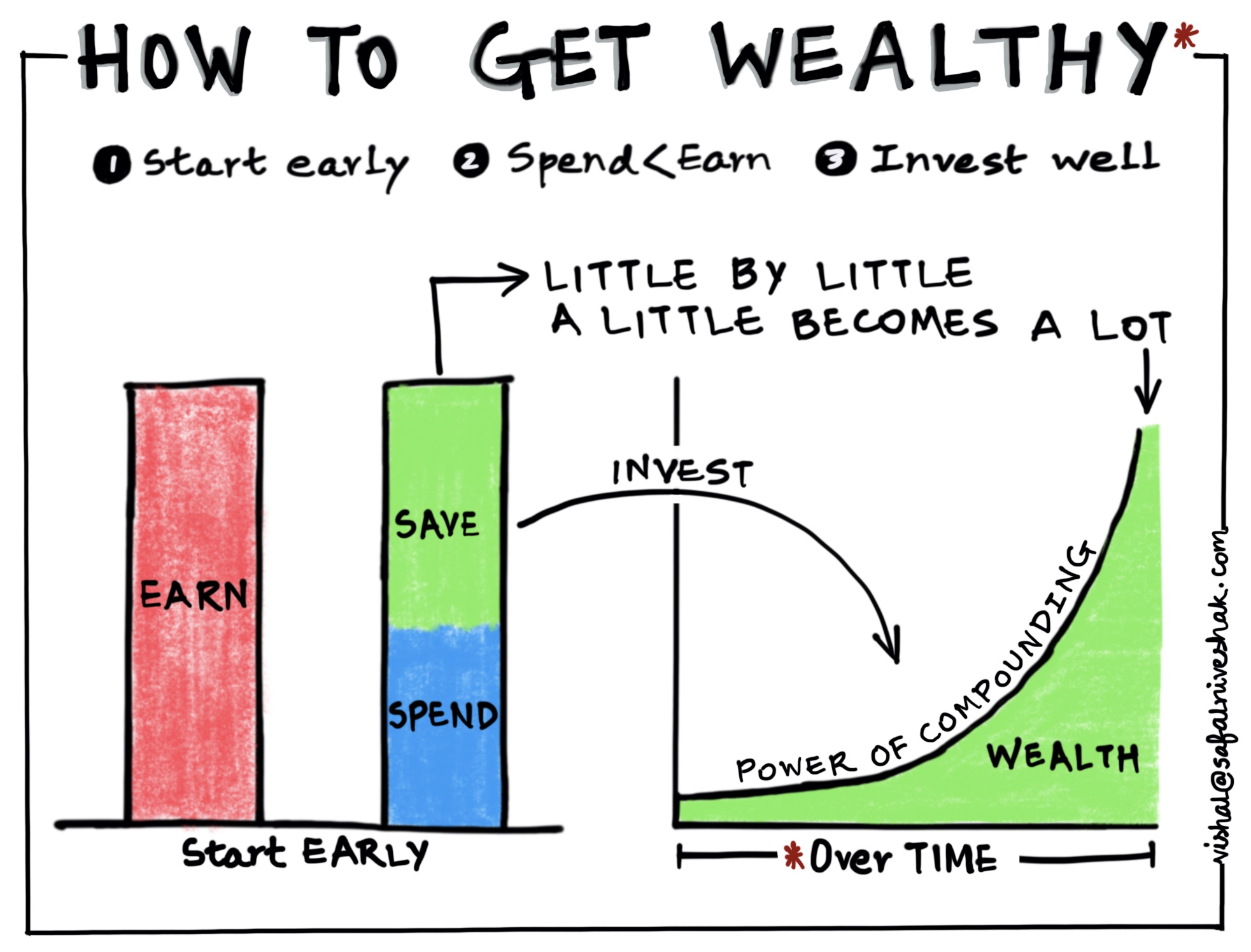

1. Learn about the magic of composition

First, to manage your money, you must have money. To earn that money, you need capitalization. This is one of the most important things taught in math to high school students, and it is important to pay attention to this particular subject in school.

Simply put, compounding is the mathematical process of multiplying your potential investment into a larger investment.

How it works?

Interest is basically the fee a bank gives to borrow your money. In compound interest, unlike simple interest, you earn both interest on the money you save and on the interest accrued over the years.

Composition is a continuous process.

Suppose Mary invested $5,000 at 10% interest.

In the first year, she will earn interest of $500, or 10% of the $5,000 she originally owned.

In the second year, Mary will earn 10% of $5,000, i.e. $500, and 10% of the interest (500%) earned so far, i.e. $50. Thus, the total interest earned will be $550.

In the third year, she will again earn 10% of $5,000, i.e. $500 and 10% of the interest earned so far, i.e. 10% (500+550) = 105. So the total interest earned in the third year would be $500 + $105 = $605.

The amount Mary will receive at the end of Year 3 will be $6655.

A whopping $1655 more than she originally invested!

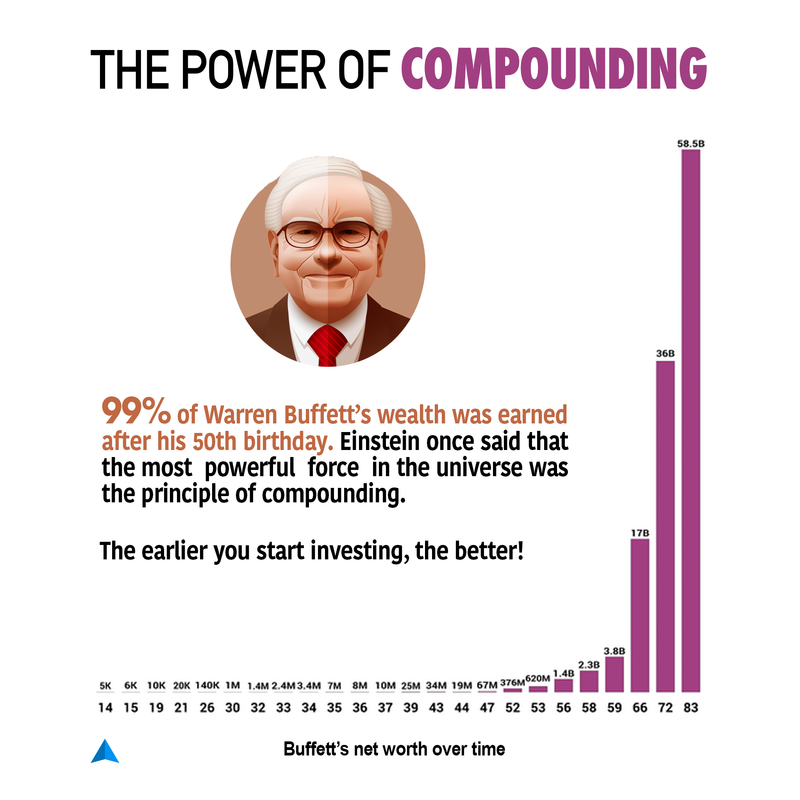

This is why it is said that the maximum benefits of compounding can be reaped in the long term. So, the sooner you start investing, the better!

Need proof?

If you still feel like you need concrete examples of how compound interest takes time to kick in, but will eventually change your life, see this-

58.5 billion.

Need I say more?

2. Start saving as little as possible, as much as possible and as soon as possible: The habit of saving

If you start putting money aside for the future at an early age, it can initiate a lifelong healthy habit of saving. To start saving, set a short or long term goal to buy something you’ve always wanted, or just a rainy day fund, and that’s it. Start putting some money toward your goal every time you receive money, whether it’s your own income, your birthday money, or your pocket money. So when you eventually get a job and start making money, you’ll get into the habit of saving, which will be extremely helpful when you retire or want to grow your wealth.

3. Create a budget

Once you have an income, whether it’s weekly pocket money or a part-time job, you need to set a weekly or monthly budget, so you don’t spend more than you earn. . To do this, I would recommend the 50/30/20 rule – 50% of your money goes to your needs, 30% to your wants (to have fun or pursue your passion) and 20% if your income is to be saved. After creating a budget for yourself, you just need to stick to it and follow it religiously. To do this, I would recommend the “Toshl Finance” app, which allows you to do unconditional budgeting and helps you track your expenses. Toshl is an app that I love for its simplicity and rich functionality. Not to mention, it’s free too! Also, if you tend to overspend, the best app for you is “PocketGuard” because it has great algorithms that track your spending and set spending limits.

4. Always spend less than you earn: avoid debt like the plague

Making sure you’re living a lifestyle that’s within your means is one of the most important things you can do when it comes to money management. Try to accumulate your discretionary income, which is the income left over after spending your money on your needs and wants. This income will be useful to you later when you are retired and you do not have a regular source of income. If you spend everything you earn, you don’t save. When you don’t save, you can never get rich. This will likely require them to borrow money from someone to pay for future expenses.

We should avoid that. Avoid debt like you avoid viruses.

Make frugality your habit. Being frugal doesn’t mean you’re miserly. Being frugal means thinking about your future. Being frugal causes you to be independent in your old age. And who doesn’t want that?

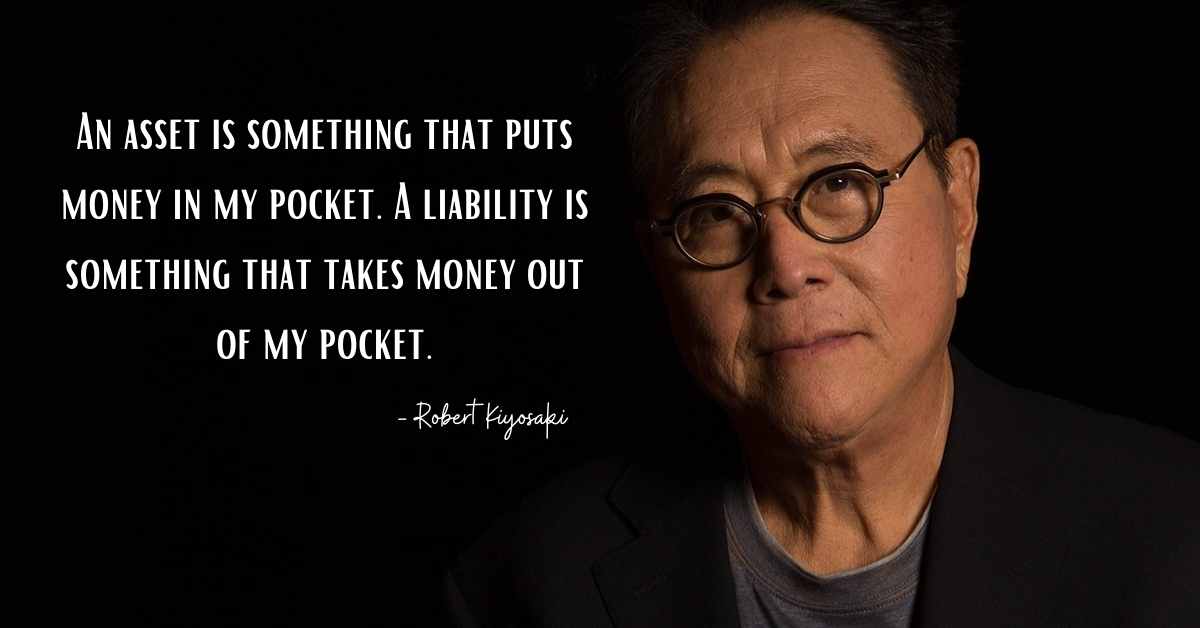

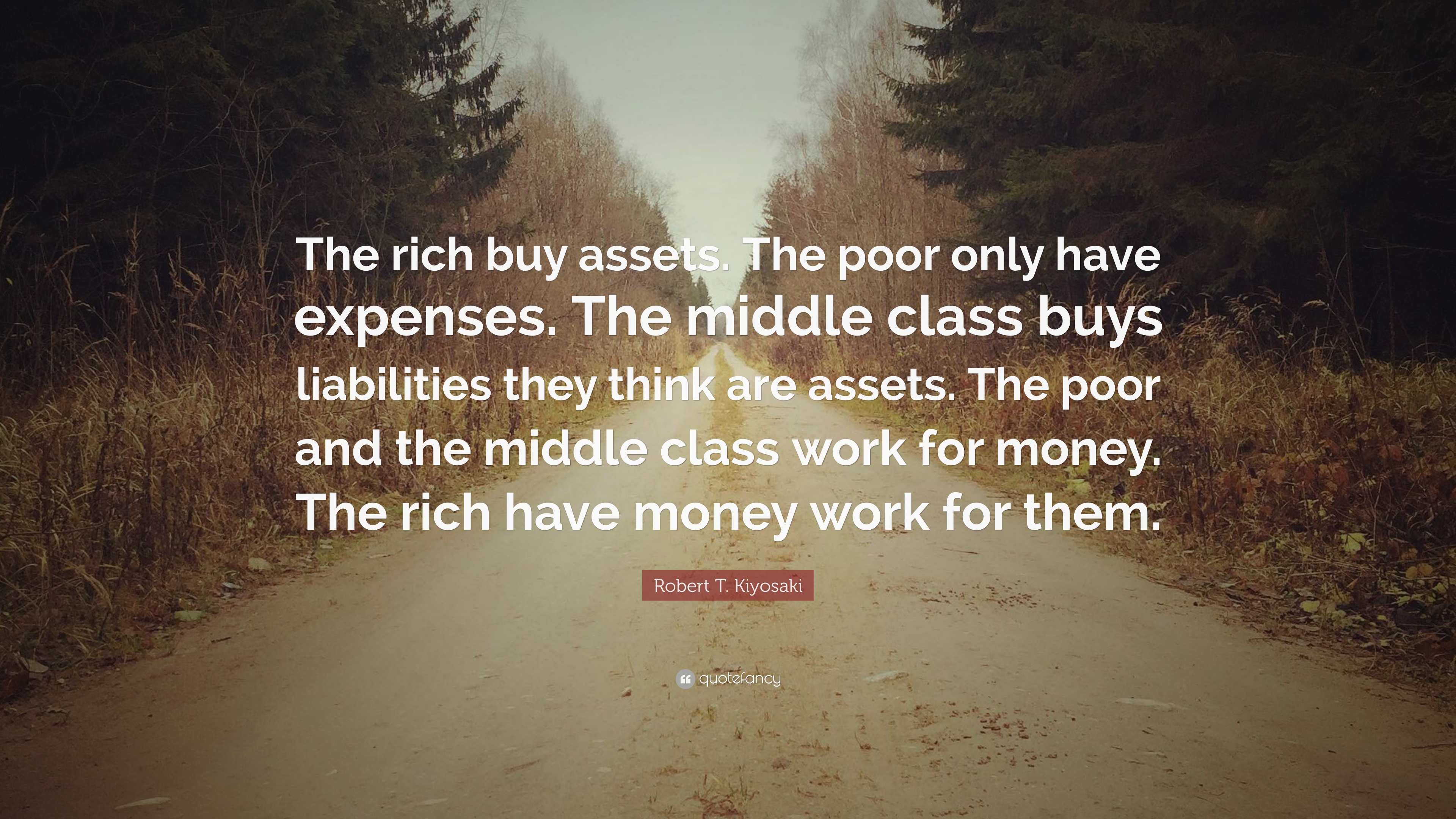

5. Learn to differentiate between assets and liabilities: your needs versus your wants

In dictionary terms, an asset is a resource that has economic value. Assets include things like money, real estate, machinery, factories, houses, etc., basically things that increase in value over time. Liabilities, on the other hand, are things you owe other parties. These are any debts you owe, such as mortgage debt or bank debt, or taxes you owe, or, if you own a business, wages you owe your employees.

Simply put, assets put money in your pocket, liabilities take it out!

Now, when it comes to personal money management, assets are the things that will add value to your life and are crucial for your proper functioning. For example, you are a writer. You have enough money to buy a phone or laptop. In this case, a phone will be less useful to you for the purpose for which you need it. In this example, the laptop is an asset, as it will help you with your writing, while the phone becomes a liability, as it will only hinder your work and reduce your productivity.

In everyday life, assets are your needs and liabilities are your wants. Assets are the reason the rich get richer and the poor stay poor. The rich purchase value. The poor buy debt. So the next time you buy something, ask yourself, “Do I really need this?” Is it an asset or a liability?

To conclude

It is absolutely essential for everyone to learn money management. Someone once said,

The art is not to make money, but to keep it

People who don’t know how to manage their money end up working for people who do. The thing everyone should understand is not to save what’s left after you spend, but spend what’s left after you save. And that awareness is what makes all the difference between a wealthy person and a broke person. It is up to us to choose which side of the spectrum we are on.