As teenagers, we should always try to prepare ourselves with skills that will be beneficial in the future. One of them is learning how to spend and save your money wisely. Even if you don’t have an income yet, managing something as small as your allowances will certainly set you up for bigger financial challenges in your adult life. Here are some tips to help you become a smarter shopper and save money!

1. Make a shopping list and stick to it at all costs.

This one’s tough if you can’t resist sales, cute items, or general impulsiveness, but it can save you a lot of money, especially if you’re an impulse shopper. List all the things you need to buy and learn to discipline yourself to only get the items you listed. To help you stick to your list, ask a friend or family member to help you with your shopping. Ask them to tell you if your buying impulse gets out of control. If that’s not possible, or if you have family and friends who always give in to what you want, move on to the next tip.

2. Ask yourself questions before buying anything

Try to ask yourself questions whenever you feel the need to purchase an item. In general, just ask yourself “Do I need this? Why do I want this? Why can I use it and for how long? I responsible enough to take care of this item for its longevity of good quality? Some more element-specific questions are:

For clothes and makeup: “Would it be suitable for everyday? If only for special occasions, how often do I need to attend such occasions? How would they fit with the things I already own?”

For books and stationery: “Do I still have blank notebooks and unread or half-read books at home? Am I buying this just because it’s visually appealing? Do I still have something like that at home?”

For the decoration and the furniture of the room: “How can I use it on a daily basis? Where will I put it, can I view it? Will I use it often?”

For frivolous items that serve no purpose (e.g. toys): “Why am I buying this? Will it keep me entertained for a long time? Do I want this just out of curiosity? Can I try to use it for free without buying it? (if you can and you’re only curious what the item looks like when used/played with, do that instead) Do I want this because it’s all over social media or because it’s currently fashionable?”

(For wanting items like this, you can usually blame the internet for giving you an irresistible urge to have them. The pressure to follow some unnecessary trend or fad can affect you more than you think. That’s just clever marketing. Fashion is going to die out sooner or later. Do you remember slimes and fidget spinners? The rainbow highlighter? Or do you know the big trend of having Pet Rocks in 1975? Stop fall for smart marketing; be a smart marketer and fight it instead.)

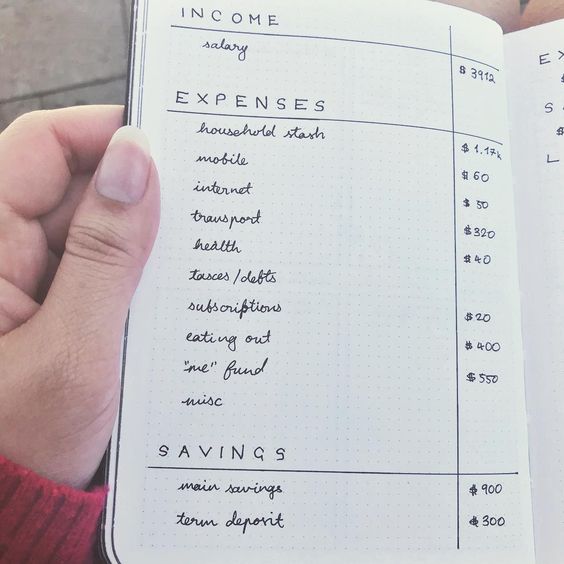

3. Set a budget

Budgeting is a great way to help you save money and avoid buying things you don’t need. It can be daily, weekly or monthly. Make sure you’re realistic when setting a budget, don’t set it too high or too low. If you have a stable allowance or income, use that as a guide. Set a goal for the amount of money you want to save on your allowance or income.

Budgeting has helped me a lot, especially when I go to places where I’m prone to overspending, like clothing stores and art supply stores. Having a limit helps me be more careful about how much I spend and what I spend on.

If you’re having trouble with budgeting on your own, you can ask someone who’s done it before or try using a mobile budgeting app. There are also apps that can sync with your bank account, so budgeting may be easier for you! Some of them customize your budget based on your income and financial goals and alert you when you’re overspending. Some great budgeting apps are Mint, Wally, and Albert. Check them!

4. Record your expenses with a personal monthly diary

Do you know accounting? Learn a very basic bookkeeping skill by creating a personal general journal. List all the money you’ve earned and all the money you’ve spent and by the end of the month you’ll be able to see what you’re spending the most of your money on. It doesn’t need to be too precise or perfect like those used in business; after all, it’s just you you care about, not the fate of a society. If you wish, you can also decorate your journal!

At the end of the month, look carefully at the journal. If you’re spending too much on morning coffee every day, maybe you can skip a few coffee-free days and try making your own at home. You had the idea. Spot where you’re spending too much money, and if it’s not a necessity or liability, try to reduce it.

5. Don’t surround yourself with people who make you a consumerist.

“Have you seen that new eyeshadow palette? Ugh, don’t you want it?”

“Come on, just this once. Do yourself a favor, buy it.”

“Let’s get some matching shirts!” (Product to push you to match an entire outfit with them)

Do you have friends like that? The words above might seem like a bit of a stretch, sounding like they came from a popular girl clique in a girl movie, but sometimes we have people in our lives who say similar things. The best way to overcome this situation is to limit your interactions with these people, especially if you feel they are greatly influencing your spending habits. However, you don’t have to completely exclude them from your life! If the person is a close friend or family member, you can give them constructive criticism by telling them directly that their words and actions are negatively impacting your spending means.

6. Stop buying things for a sense of security

Trend after trend fills our social media feeds. Later, you will start to see your friends wearing this hot new item or talking about it endlessly. Then you will realize that you don’t have what everyone raves about. You’ll start thinking, “Should I buy one for myself?”

When you buy something for yourself, make sure you’re buying it because you really like what you’re buying. Sometimes we feel like we like a certain article because it’s all over the internet, even though deep down we know the trend will die out in a few months. You’ll start having purchases you’ll regret making because of it.

Learn the difference between wanting something because you really want it or wanting something to feel safe in this increasingly consumerist society. Satisfaction in life isn’t just about constantly browsing for new items to appease that urge to fit inside of you.

Not only is it good for your wallet, but it’s also extremely healthy for your mental health. In the end, you’ll end up with a lot of savings by holding out to buy things you don’t actually need, and you can use it for more useful purchases.

7. Prioritize

Your school bag’s zipper is stuck, your phone’s screen is cracked, some of your clothes have grown too big… But your favorite author recently released a long-awaited addition to your favorite series, a company makeup artist and your favorite beauty YouTuber have made a collaboration palette you plan to save up for and there’s this really cool video game you don’t have. Which should you spend first on? Well, it seems pretty obvious when you read it here, but in reality it can be a lot harder to decide. What can you do to resist the temptation to spend on less important things?

Write down your priorities on a sheet of paper, from most important to least important. Which should be immediately covered? Who can wait a little longer?

8. Wait for your impulsive desires to die out

A very effective way to stop impulse buying for things that are not very essential is to wait a day or two before buying what you have in mind. For things that will cost you a larger amount of money, wait a month. List them for now, and when you don’t want them anymore, just cross them out.

9. Save your small changes

Honestly, loose change can get boring sometimes. But they still have some value in them, especially if you keep them instead of throwing them away! Put your change aside and put it in some container. Continue to put change and wait until your container is full. You will be surprised how much money you will get from all saved changes!

10. Invest in good quality items

This tip might seem questionable at first, knowing how much higher quality items can cost you more, but believe me, it will cost you less in the long run. When you buy good quality items, you won’t need to spend more on replacement or repair, which is often the case with cheaper items. This is especially true for clothes, bags, shoes, and furniture, as you need these items to be durable enough to be used for a long time.

What do you think of these tips? Which would you like to try first?